Press Release

HSBC Global Asset Management collaborates with Carbon4 Finance to refine its analysis of the climate impact of issuers.

Today, the climate impact of companies is assessed through a static indicator: the carbon intensity, which measures, at a given moment, the company's carbon emissions. To achieve the 2° C target of the Paris Climate Agreement, it is also necessary to look at the reality of a company's strategic and financial commitment to a low carbon transition. The unique metric making possible to quantity this commitment today is the indicator which measures "avoided carbon emissions1" developed by Carbon4 Finance. This is the reason why HSBC Global Asset Management is starting a collaboration with Carbon4 Finance to refine its analysis of the invested companies regarding their climate trajectory.

"While measuring the carbon footprint is now quite common, measuring the real impact of companies in the medium to long term is proving difficult. However, we believe that the measurement of "avoided carbon emissions" developed by Carbon4 Finance is an excellent way to assess the climate trajectory of companies and that is why we have chosen to integrate it. This new climate metric may over time play a significant role in our overall process of integrating ESG factors, covering all geographies and all asset classes. “explains Xavier Desmadryl, Global Head of ESG Research & PRI, at HSBC Global Asset Management

Marie-Anne Vincent, Head of Business Development at Carbon4 Finance, says: “Identifying the real actors towards a low-carbon economy is a key challenge for all investors and we are proud to have been chosen by HSBC Global Asset Management in this initiative, that we hope is illustrative of a new way to manage investments.”

What are ‘avoided carbon emissions’ and why are they so important to consider?

In order to evaluate the alignment of a portfolio with the low-carbon transition, it is necessary to look beyond the carbon footprint and identify the opportunities and real actors of the climate transition: for example, by evaluating a company’s capacity to reduce its emissions, by enabling its customers or suppliers to decarbonize theirs, etc.

Carbon4 Finance developed an additional indicator within its transition risk methodology, Carbon Impact Analytics, to calculate the emissions savings (scopes 1, 2 and 3) of a company to steer investments towards solutions for a decarbonized economy.

Jean-Marc Jancovici, one of Carbon4 Finance partners, says: “to appreciate to what extent a company is resilient, or even favoured by, a low carbon transition, calculating avoided emissions is unavoidable”.

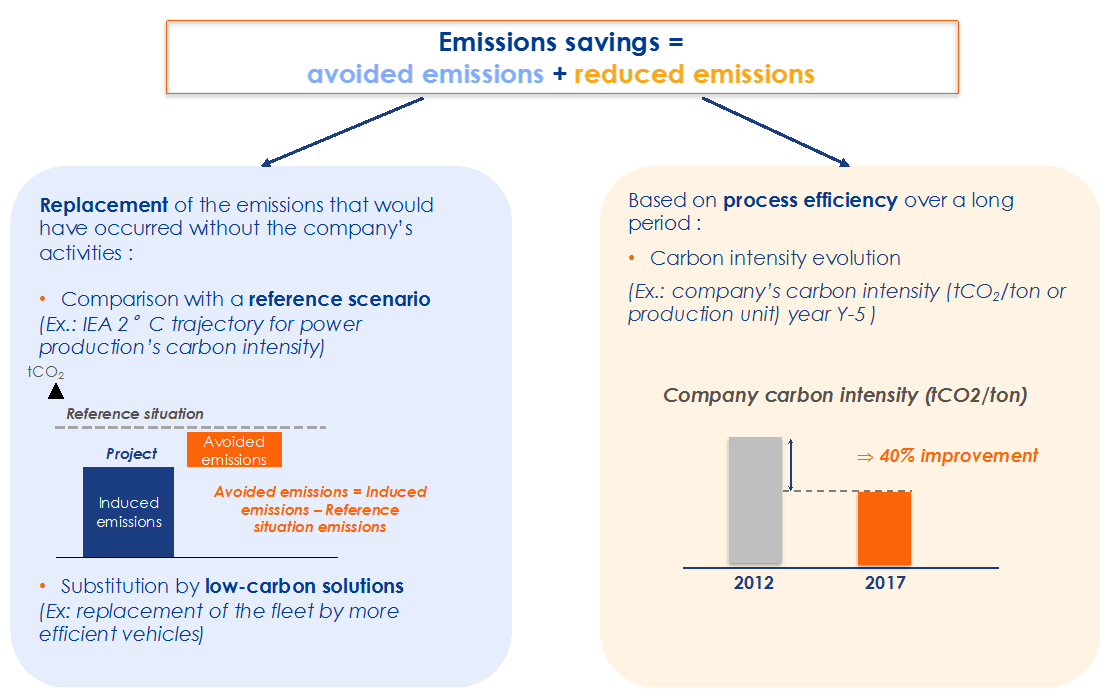

1 Emissions savings are calculated by adding up the “avoided emissions” (comparing the company to the trajectory of its sector) and the “reduced emissions” of a company (comparing the company with itself over 5 years)

A company operating in a highly carbon intensive sector could contribute significantly to decreasing emissions by creating a disruptive product or process. For example, an insulation manufacturer or a bicycle manufacturer can emit a massive volume of greenhouse gas when looking only at the direct emissions, but nevertheless have a very positive contribution to the climate transition over the whole lifetime of their products.

The inclusion of emissions savings is crucial in order to help understand how disruptive a company is, either through more efficient processes, or through low carbon products or services.

Emissions savings are calculated by adding up the “avoided emissions” (comparing the company to the trajectory of its sector) and the “reduced emissions” of a company (comparing the company with itself over 5 years):

- avoided emissions are the emissions that are avoided by the company’s products and services; they are calculated by comparing the emissions with a sectorial baseline scenario (i.e. an IEA scenario 2°), or with the substitution by low-carbon solutions. A company avoids emissions if there is a positive gain between the induced emissions of the company on the one hand, and the baseline sectoral emissions scenario on the other hand.

- reduced emissions are the volume of emissions lowered through a process efficiency over a period of time: an emissions reduction is a real decrease of the company’s carbon intensity over 5 years.

The “emission savings” indicator is key to understand the real impact of a company. This indicator is a powerful tool in order to identify the companies that have already entered into the climate transition and to measure the company’s action for the low carbon transition, providing figures that are much more meaningful and tangible than all the companies statements that claim carbon neutrality.

Media enquiries to:

Charles Clarke

+44(0) 207 991 8805

charleswclarke@hsbc.com

Sophie Ricord

+33 1 40 70 33 05

sophie.ricord@hsbc.fr

Alexia Soyeux

+33 1 76 21 10 00

Alexia.soyeux@carbone4.com

This press release is produced by HSBC Global Asset Management and Carbon4 Finance

The information contained herein is subject to change without notice. All non-authorised reproduction or use of this commentary and analysis will be the responsibility of the user and will be likely to lead to legal proceedings. This press release has no contractual value and is not by any means intended as a solicitation, nor an investment advice for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. Tax treatment depends on The individual circumstances of each client and may be subject to change in The future. Capital is not guaranteed. It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed.

The commentary and analysis presented in this document reflect the opinion of HSBC Global Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Global Asset Management.

Consequently, HSBC Global Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document.

All data from HSBC Global Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Global Asset Management

HSBC Global Asset Management should be referred to in full at all times to avoid confusion with any other financial services firms.

HSBC Global Asset Management, the investment management business of the HSBC Group, invests on behalf of HSBC’s worldwide customer base of retail and private clients, intermediaries, corporates and institutions through both segregated accounts and pooled funds. HSBC Global Asset Management connects HSBC’s clients with investment opportunities around the world through an international network of offices in 25 countries and territories, delivering global capabilities with local market insight. As at 30 June 2020, HSBC Global Asset Management managed assets totalling USD525 billion on behalf of its clients. For more information, see www.global.assetmanagement.hsbc.com

HSBC Global Asset Management is the marketing name for the asset management businesses of HSBC Holdings plc.

The HSBC Group

HSBC Holdings plc

HSBC Holdings plc, the parent company of the HSBC Group, is headquartered in London. HSBC serves customers worldwide from offices in 64 countries and territories in our geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of USD2,923 billion at 30 June 2020, HSBC is one of the world’s largest banking and financial services organisations.

About Carbon4 Finance

Launched in 2016 and based in Paris, Carbon4 Finance brings to the financial sector the expertise of the consulting firm Carbone 4, which since 2007 has provided services in carbon accounting, scenario analysis and advice in all economic sectors.

Carbon4 Finance offers a complete set of climate data solutions covering both physical risk (CRIS Methodology: Climate Risk Impact Screening) and transition risk (CIA Methodology: Carbon Impact Analytics). These proprietary methodologies allow financial organisations to measure the carbon footprint of their portfolio, assess the alignment with a 2°C-compatible scenario and measure the level of risks that arise from events related to climate change.

Carbon4 Finance applies a rigorous “bottom-up” research-based approach, which means that each asset is analysed individually and in a discriminating manner. For more information, please visit www.carbon4finance.com